As it comes up to the end of the financial year, now is a good time to review Gift Aid, and to make sure that your congregation are making the most of this opportunity. This might be a good time for the treasurer or gift aid officer to remind people of who can gift aid, and to make forms available. You could even remind people that gift aid can be backdated for gifts for the previous four years.

What records should we keep?

HMRC from time to time visit charities. You should ensure you keep sufficient records to show your tax reclaims are accurate, including: auditable records of all Gift Aid Declarations you receive; any cancellations of Declarations; any benefits you have provided to donors; and donations that you receive; correspondence about donations with donors.

Are you making the most of your Gift Aid Small Donations Scheme?

If you have more than one church building in your parish (eg a church hall) then you may be able to increase the total amount you can claim.

There is lots of great information here: https://www.parishresources.org.uk/giftaid/

Who can sign a gift aid form?

In one financial year you must have paid at least 25p in income or capital gains tax for every 1 you donate to charity. Every Income Tax payer has a tax-exempt threshold before they start paying tax. So please ensure you are paying enough tax to Gift Aid your donations. For April 2020-21 the government has set the tax exempt threshold at 12,500.

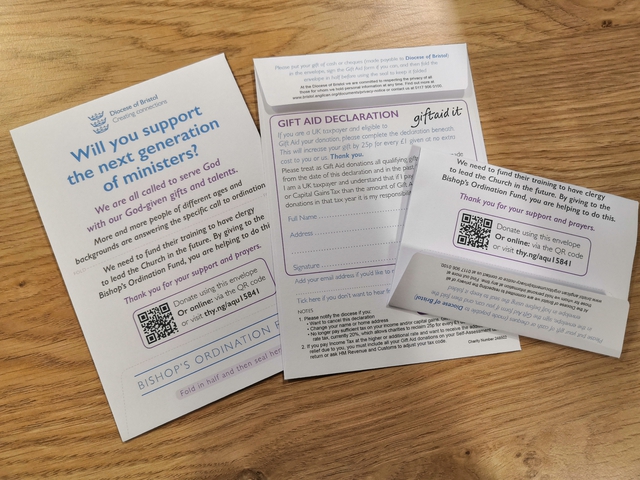

You may want to consider bespoke gift aid envelopes. The Diocese recently ordered C6 size peel and seal envelopes printed front and back. The cost of 2500 was only 180.00 plus VAT. These can be folded in half and sealed for data protection security. You can easily design these yourselves, so that the gift aid envelope explains nicely why it is important to give to your church. Our envelopes also have a link to a simple mobile website so that people can give online if they dont have cheques or cash handy this uses a website called thyngs and is free to set up. They just take a small percentage as admin.